Last updated: 20th March, 2024

Palremit General Terms of Use

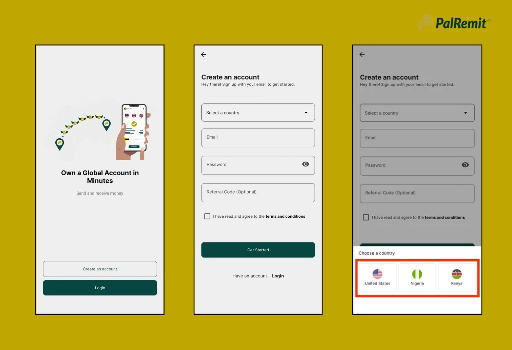

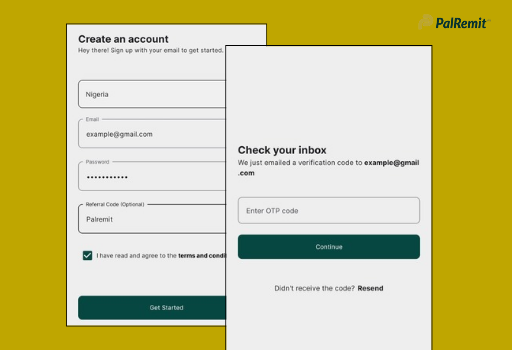

PLEASE READ THESE GENERAL TERMS OF USE CAREFULLY BEFORE ACCEPTING THEM (BEFORE AGREEING TO THE CONDITIONS CONTAINED IN THEM). BY CLICKING THE “CREATE ACCOUNT” BUTTON OR BY ACCESSING OR USING THE SERVICES, YOU AGREE TO BE LEGALLY BOUND BY THESE GENERAL TERMS OF USE AND ALL TERMS INCORPORATED BY REFERENCE.

BY MAKING USE OF SERVICES, YOU ACKNOWLEDGE AND AGREE THAT: (1) YOU ARE AWARE OF THE RISKS ASSOCIATED WITH TRANSACTIONS OF DIGITAL CURRENCIES AND/OR ASSETS; (2) YOU SHALL ASSUME ALL RISKS RELATED TO THE USE OF SERVICES AND TRANSACTIONS OF DIGITAL CURRENCIES AND THEIR DERIVATIVES; AND (3) BANXE SHALL NOT BE LIABLE FOR ANY SUCH RISKS OR ADVERSE OUTCOMES.

BY ACCESSING AND USING SERVICES, YOU REPRESENT AND WARRANT THAT YOU HAVE NOT BEEN INCLUDED IN ANY TRADE EMBARGOES OR ECONOMIC SANCTIONS LIST (SUCH AS THE UNITED NATIONS SECURITY COUNCIL SANCTIONS LIST), THE LIST OF SPECIALLY DESIGNATED NATIONALS MAINTAINED BY OFAC (THE OFFICE OF FOREIGN ASSETS CONTROL OF THE U.S. DEPARTMENT OF THE TREASURY), OR THE DENIED PERSONS OR ENTITY LIST OF THE U.S. DEPARTMENT OF COMMERCE. WE RESERVE THE RIGHT TO CHOOSE MARKETS AND JURISDICTIONS TO CONDUCT BUSINESS AND MAY RESTRICT OR REFUSE THE PROVISION OF SERVICES IN CERTAIN COUNTRIES OR REGIONS.

This General Terms of Use applies to customers residing outside the “Prohibited Jurisdictions,” details of which can be found at https://help.palremit.com.

1. Acceptance of the General Terms of Use

1.1. These General Terms of Use are entered into by and between you and Choise Services UAB, a legal entity duly registered in Lithuania with 305964183 with aregistered office at Vokieciu gatve 18a-7, Vilnius, (“Choise”, “we”, “us”), and Charism LLC, a limited liability company, incorporated in St. Vincent andGrenadines with company number 1999 LLC 2022, registered office at Suite 336, Beachmont Business Centre, Kingstown, St. Vincent, and Grenadines, and Crypterium AS, a legal entity duly registered in Estonia with No. 14352837,registered office at Harju maakond, Tallinn, Kesklinna linnaosa, A. Lauteri tn 5, 10114 (“Associated companies”).

1.2. The Website and Mobile Applications are owned by the company Palremit Corporation, incorporated in the State Delaware with a registered number5480901 and registered office at 8 The Grn Ste A Dover, Delaware 19901-3618, USA (Palremit).

1.3. By using the Website or any Services or by clicking to accept or agree to the Terms of Use when this option is made available to you, you accept and agree to be bound and abide by these Terms of Use in addition to

- our Privacy Policy, incorporated herein by reference; and

- our Cookie Policy, incorporated herein by reference; and

- our KYC/AML Policy, incorporated herein by reference; and

- our Anti-fraud Policy, incorporated herein by reference; and

- our Terms of Exchange Operations, incorporated herein by reference; and

- our IP notice, incorporated herein by reference.

1.4. The following terms and conditions, together with any documents they expressly incorporate by reference (collectively, these “Terms of Use”), govern your access to and use of https://palremit.com/ (“Website”), including any associated mobile applications (“Applications”) and your access to and use of any media, analytics, content, functionality, and services offered on or through any of the Website and Applications, and your access to and use of all and any related sites and services. The Website, the Applications, and all and any other media, analytics, content, functionality, Services, and services offered by us or through us, are referred to as the “Services”. If you do not agree to these Terms of Use, you must not access or use the Website and any Services or any Application or access or use any Services.

2. Usage Requirements

2.1. The Website is offered and available to users who are of legal age (i) in Saint Vincent and Grenadines (18 years or older) and (ii) in the users’ jurisdiction or place of residence.

2.2. By using a Website and any Services, you represent and warrant that you (i) are 18 years of age or older, (ii) are of legal age in your jurisdiction or place of residence, (iii) are not barred from using the Website and any Services under any applicable law, order, directive, regulation, or sanction list and (iii) are using the Website and any Services only for a lawful purpose.

If you do not meet these requirements, you must not access or use the Website and any Services.

2.3. As a Client, that is a legal entity, on behalf of such legal entity you represent and warrant that (i) such legal entity is duly organized and validly exists under the legislation of the jurisdiction of its organization; (ii) you are duly authorized by such legal entity to act on its behalf; and (iii) this legal entity is not registered in the Prohibited Jurisdictions, as well as the beneficial owners of this legal entity are not citizens (nationals) of the countries that are in the list of Prohibited Jurisdictions and do not reside in the Prohibited Jurisdictions.

3. Content and its intended use

3.1. We may change the format and content of the Website and the Services from time to time without noticing you. You agree that your use of the Websites and the Services is on an ‘as is’ and ‘as available’ basis and is at your sole risk.

3.2. Whilst we try to make sure that all information contained in the Websites and any Services (other than any user-generated content) is correct, it is not, and it is not intended to be, any authority or advice on which any reliance should be placed.

4. Reliance on Information Posted

4.1. The information presented on or through the Websites and any Services is made available solely for general information purposes. We do not warrant the accuracy, completeness, or usefulness of this information. Any reliance you place on such information is strictly at your own risk. We disclaim all liability and responsibility arising from any reliance placed on such materials by you or any other visitor to the Websites, or by anyone who may be informed of any of its contents.

4.2. The Website and any Services may include content provided by third parties, including materials provided by other users, bloggers, and third-party licensors, syndicators, aggregators, and/or reporting services. All statements and/or opinions expressed in these materials, and all articles and responses to questions and other content, other than the content provided by the Company, are solely the opinions and the responsibility of the person or entity providing those materials. These materials do not necessarily reflect the opinion of the Company. We are not responsible, or liable to you or any third party, for the content or accuracy of any materials provided by any third parties.

4.3. The Website and the Services are not in any manner or in any form or part intended to constitute or form the basis of any advice (professional or otherwise) or to be used in, or about, any investment or other decision or transaction.

4.4. We do not accept any liability (regardless of how it might arise) for any claim or loss arising from:

- any advice given;

- any investment or other decision made; or

- any transaction made or effected;

- in reliance on, or based on, any information on the Websites or in any of the Services, nor do we accept any liability arising from any other use of, or reliance on, the Services.

4.5. We do not enter into any terms or make any representations as to the accuracy, completeness, currency, correctness, reliability, integrity, quality, fitness for purpose, or originality of any content of the Websites and the Services and, to the fullest extent permitted by law, all implied warranties, conditions or other terms of any kind are hereby excluded. To the fullest extent permitted by law, we accept no liability for any loss or damage of any kind incurred as a result of you or anyone else using the Websites and the Services or relying on any of its content.

4.6. We cannot and do not guarantee that any content of any Website and any Services will be free from viruses and/or other code that may have contaminated or destructive elements. It is your responsibility to implement appropriate IT security safeguards (including antivirus and other security checks) to satisfy your requirements for the safety and reliability of content.

5. Changes to the Terms of Use

5.1. We may revise and update these Terms of Use from time to time at our sole discretion. All changes are effective immediately when we post them.

5.2. Your continued use of the Websites and any Services following the posting of revised Terms of Use means that you accept and agree to the changes. You are expected to check this page frequently, so you are aware of any changes, as they are binding on you.

6. Accessing the Websites

6.1. We reserve the right to withdraw or amend this Website, and any service or material we provide on the Website and any Services, in our sole discretion without notice. We do not guarantee that our Website or any content on it will always be available or will not be interrupted. We will not be liable if for any reason all or any part of the Websites and any Services is unavailable at any time or for any period. From time to time, we may restrict access to some parts of the Websites and any Services, or an entire Website, to users.

6.2. You are responsible for:

- Make all arrangements necessary for you to have access to the Websites and any Services.

- Ensuring that all persons who access the Websites and any Services through your internet connection are aware of these Terms of Use and comply with them.

6.3. To access a Website or some of the resources it offers, you may be asked to provide certain registration details or other information. It is a condition of your use of the Website that all the information you provide on the Website is correct, current, and complete. You agree that all information you provide to register using a Website or otherwise, including, but not limited to, using any interactive features on the Website, is governed by our Privacy Policy, and you consent to all actions we take concerning your information consistent with our Privacy Policy.

6.4. You should use caution when inputting personal information onto Websites on a public or shared computer so that others are not able to view or record your personal information.

7. Mobile Applications

7.1. Apple Application

7.1.1 If the Services that you access and use is an Apple Application:

the Apple Application may be accessed and used only on a device owned or controlled by you and using the Apple iPhone OS;

7.1. 2. You acknowledge and agree that:

- Apple has no obligation at all to provide any support or maintenance services concerning the Apple Application. If you have any maintenance or support questions concerning the Apple Application, please contact us, not Apple, using the contacting us details at the end of these Terms of Use;

- although these Terms of Use are entered between us and you (and not Apple), Apple, as a third-party beneficiary under these Terms of Use, will have the right to enforce these Terms of Use against you;

- except as otherwise expressly set out in these Terms of Use, any claims relating to the possession or use of the Apple Application are between you and us (and not between you, or anyone else, and Apple); and

- in the event of any claim by a third party that your possession or use (in accordance with these Terms of Use) of the Apple Application infringes any intellectual property rights, Apple will not be responsible or liable to you concerning that claim;

7.1.3. You represent and warrant that:

- You are not, and will not be, located in any country that is the subject of a US Government embargo or that has been determined by the US Government as a “terrorist supporting” country; and

- you are not listed on any US Government list of prohibited or restricted parties; and

- If the Apple Application that you have purchased does not conform to any warranty applying to it, you may notify Apple, which may then refund the purchase price of the Apple Application to you. Subject to that, and to the maximum extent permitted by law, Apple does not give or enter into any warranty, condition, or other term concerning the Apple Application and will not be liable to you for any claims, losses, costs, or expenses of whatever nature concerning the Apple Application or as a result of you or anyone else using the Apple Application or relying on any of its content.

7.2. Android Applications

7.2.1. If the Services that you access, and use an Android Application:

the Android Application may be accessed and used only on a device owned or controlled by you and using an Android OS;

7.2.2. You acknowledge and agree that:

- Google has no obligation at all to provide any support or maintenance services concerning the Android Application. If you have any maintenance or support questions concerning the Android Application, please contact us, not Google, using the contacting us details at the end of these Terms of Use;

- although these Terms of Use are entered into between us and you (and not Google), Google, as a third-party beneficiary under these Terms of Use, will have the right to enforce these Terms of Use against you;

- unless otherwise expressly set out in these Terms of Use, any claims relating to the possession or use of the Android Application are between you and us (and not between you, anyone else, and Google); and

- in the event of any claim by a third party that your possession or use (in accordance with these Terms of Use) of the Android Application infringes any intellectual property rights, Google will not be responsible or liable to you concerning that claim; and

7.2.3. You represent and warrant that:

- You are not, and will not be, located in any country that is the subject of a US Government embargo or that has been designated by the US Government as a “terrorist supporting” country; and

- You are not listed on any US Government list of prohibited or restricted parties.

Account Security

8.1. Be careful to keep your private keys, passwords, security codes, and other security features that you use to access the Services. You must maintain the security of your Account by protecting your login, password, and security credentials from unauthorised access or use. It is your responsibility to ensure the security of, and your continuous control over, any device or account that may be associated with enhanced security features. You must properly read, use, and follow the Anti-fraud policy, and notify us if you discover or suspect any unauthorized access or use of your Account or any security breaches related to your Account. Upon receipt of written notice from you that the security of your Account has been compromised, we will take reasonable steps to protect your Account.

8.2. Please note that You are responsible for all activities that occur under your Account, and by agreeing to these Terms you accept all risks of any authorized or unauthorized access to your Account. You will be bound by, and you hereby authorize us to accept and rely on, any agreements, instructions, orders, authorizations, and any other actions made, provided, or taken by anyone who has accessed or used your Account regardless of whether the access is authorized or unauthorized by you.

Please note that you may open only one Account as well as reach an agreement with other persons on joint and (or) coordinated actions on using the Accounts in a certain way (including for making a profit (generating income) or to achieve other goals). Creation of more than one Account is strongly prohibited and may lead to refusal of providing our services.

9. Trademarks

9.1. Our name, the brand “Choise.com” (application number 2022703181 as of 21.01.2022) “Choise” (application number 2022703182 as of 21.01.2022), our logo and all related names, logos, Services and service names, designs, and slogans are trademarks. You must not use such marks without prior written permission. All names, logos, Services and service names, designs, and slogans on the Websites and any Services (“Marks”) are the trademarks of their respective owners.

9.2. Nothing contained in the Websites or any Services should be construed as granting any license or right to use any of the Marks for any purpose whatsoever without the written permission of, or entry into the applicable license terms with, the lawful owner. Unauthorized use of the Marks or any information is strictly prohibited and may violate trademark, copyright, or other applicable laws. In the event you print off, copy, or store any of our content (which you may do only as permitted by these Terms of Use), you must ensure that any copyright, trademark, or other intellectual property right notices contained in the original content are reproduced.

10. Services

10.1. Charism LLC provides the following services following this Terms of Use:

- Providing services for opening the User Account

- Providing services for exchanging one crypto asset for another one

- Providing services for crypto credits

- Providing services for crypto savings, including dual currency deposits.

The Charism LLC is not responsible and does not assume any liability whatsoever for acts, errors, or omissions of any third party.

10.2. Choise Services UAB provides the following services following this Terms of Use:

- Providing services for exchanging crypto assets to fiat and vice versa (including insured exchange operations)

The Choise Services UAB is not responsible and does not assume any liability whatsoever for acts, errors, or omissions of any third party.

10.3. Crypterium AS provides the following services in accordance with these Terms of Use:

- Providing services registration and onboarding of users,

- Providing services of implementation Anti-Money Laundering/Know Your Customer principles on Website

10.4. We may share your personal data with third parties for purposes of providing services described in this Clause. Please check our Privacy Policy for more details.

11. Prohibited Uses

11.1. You may use the Websites and any Services only for lawful purposes and in accordance with these Terms of Use. You agree not to use the Websites and any Services:

- In any way that violates any applicable national, regional, local, or international law or regulation (including, without limitation, any laws regarding the export of data or software to and from the EU or other countries).

- For the purpose of exploiting, harming, or attempting to exploit or harm minors in any way by exposing them to inappropriate content, asking for personally identifiable information, or otherwise.

- To send, knowingly receive, upload, download, use, or re-use any material which does not comply with these Terms of Use.

- To transmit, or procure the sending of, any advertising or promotional material without our prior written consent, including any “junk mail”, “chain letter” “spam” or any other similar solicitation.

- To impersonate or attempt to impersonate the Company, a Company employee, another user, or any other person or entity (including, without limitation, by using email addresses or screen names associated with any of the foregoing).

- To engage in any other conduct that restricts or inhibits anyone’s use or enjoyment of the Websites and any Services, or which, as determined by us, may harm the Company or users of the Websites and any Services or expose them to liability.

Additionally, you agree not to:

- republish, redistribute, or re-transmit any data from any of our communications, analytics, and other Services without our permission;

- copy or store any of our Services other than for your personal non-commercial use and as may occur incidentally in the normal course of use of your browser or mobile device;

- store any Services (including pages of a Website) on a server or other storage device connected to a network or create a database by systematically downloading and storing any data from the Website or the Services;

- remove or change any content of any Services or attempt to circumvent security or interfere with the proper working of the Services or any servers on which it is hosted;

- create links to a Website from any other website, without our prior written consent, although you may link from a website that is owned and operated by you provided that (a) the link is not misleading or deceptive and fairly indicates its destination, (b) you do not state or imply that we endorse you, your website, or any Services or services you offer, (c) you do not create any misimpression or confusion among users concerning sponsorship or affiliation, (d) you link only to the home page of the Website and (e) the linked website does not contain any content that is unlawful, threatening, abusive, libellous, pornographic, obscene, vulgar, indecent, offensive or which infringes on the intellectual property rights or other rights of any third party;

- use the Websites or any Services in any manner that could disable, overburden, damage, or impair the site or interfere with any other party’s use of the Websites and any Services, including their ability to engage in real-time activities through the Website and any Services;

- use any robot, spider, or other automatic device, process, or means to access the Websites for any purpose, including monitoring or copying any of the material on the Websites;

- create (whether for yourself or someone else) any financial Services or service which seeks to match the performance of or the capital or income value of which is related to, any of our Services or services;

- use any manual process to monitor or copy any of the material on a Website or for any other unauthorized purpose without our prior written consent.

- use any device, software, or routine that interferes with the proper working of a Website.

- introduce any viruses, trojan horses, worms, logic bombs, or other material that is malicious or technologically harmful.

- attempt to gain unauthorized access to, interfere with, damage, or disrupt any parts of a Website, the server on which the Websites are stored, or any server, computer, or database connected to any Website.

- attack any Website via a denial-of-service attack or a distributed denial-of-service attack.

- otherwise, attempt to interfere with the proper working of the Website.

- Except to the extent expressly set out in these Terms of Use, you are not allowed to:

- otherwise, do anything concerning any of the Services that is not expressly permitted by these Terms of Use.

- You must use the Websites and the Services, and anything available via such, only for lawful purposes (complying with all applicable laws and regulations), in a responsible manner, and not in a way that might damage our name or reputation or that of any of our affiliates.

- All rights granted to you under these Terms of Use will terminate immediately if you breach or fail to comply with any of these Terms of Use.

- To do anything with the Websites and the Services that are not expressly permitted by these Terms of Use, you will need a separate license from us. Please contact us via [email protected]

12. Changes to the Website

12.1. We may update the content on any Website and any Services from time to time,

but its content is not necessarily complete or up-to-date. Any of the material on any Website or in any Services may be out of date at any given time, and we are under no obligation to update such material.

13. Information About You and Your Visits to the Websites

13.1. All information we collect on this Website is subject to our Privacy Policy. By using the Website, you consent to all actions taken by us concerning your information in compliance with the Privacy Policy.

14. Confidential Information

14.1. When using a Website or any Services, data may be transmitted over an open network which may allow such communications to be intercepted by third parties. As a result, we cannot guarantee the confidentiality or security of any communication or data that you may transmit to us through the Websites.

15. Other Terms and Conditions

15.1. Additional terms and conditions may also apply to specific services or features of the Websites and any Services, including the promo rules in respect to the promotional events, public competitions and other event. All such additional terms and conditions are hereby incorporated by this reference into these Terms of Use.

16. Links from the Websites

16.1. If a Website contains links to other sites and resources provided by third parties, these links are provided for your convenience only. This includes links contained in advertisements, including banner advertisements and sponsored links. We have no control over the contents of those sites or resources and accept no responsibility for them or for any loss or damage that may arise from your use of them. If you decide to access any of the third-party websites linked to any Website, you do so entirely at your own risk and subject to the terms and conditions of use for such websites. We reserve the right to withdraw linking permission without notice.

17. Third party services

17.1. Certain features of our Websites and Services may utilize the services and/or Services of third-party vendors and business partners, which services and/or Services may include software, information, data or other services. Certain of these vendors and business partners require users who utilize such features to agree to additional terms and conditions. This page identifies third-party terms and conditions that are required by such third-party vendors and business partners as they apply to the features set forth below. Your uses of such features constitute your agreement to be bound by these additional terms and conditions. These third-party terms are subject to change at such third party’s discretion.

17.2. The Company is not responsible and does not assume any liability whatsoever for acts, errors or omissions of any third-party service provider.

18. Risk warnings

18.1. Trading of goods, real or virtual, which include virtual currencies (cryptocurrencies), involves a significant level of risk. Prices can fluctuate on any given day. Because of such price fluctuations, you may gain or lose value of your assets any moment. Currency may be subject to large swings in value and may even become worthless. You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. We have highlighted some of those risks below:

- Traders put their trust in a digital, decentralized and partially anonymous system that relies on peer-to-peer (network in which interconnected nodes (“peers”) share resources amongst each other without the use of a centralized administrative system) networking and cryptography to maintain its integrity. This means that there is no central bank that can take corrective measures to protect the value of cryptocurrency in a crisis or issue more currency.

- Cryptocurrency trading is probably susceptible to irrational (or rational) bubbles or loss of confidence, which could collapse in demand relative to supply. For example, due to the fundamentals of the cryptocurrency trading system’s functioning, it is vulnerable to fluctuations in the level of confidence of market participants, which directly affects the level of demand or supply. The level of confidence can be affected both by purely economic factors and non-economic, including technological ones.

- Cryptocurrency transactions are irreversible. If you send cryptocurrency to an incorrect address, or send the wrong amount, you cannot get it back. We will not be liable for executing a transaction if the instruction relates to an incorrect address.

- Our website may suffer the failure of hardware, software, and Internet connections which may lead to communication failures, disruptions, errors, distortions or delays in payments and trading. You acknowledge that we will not be responsible for that.

- Any opinions, news, research, analyses, prices, or other information contained on Website are provided as general market commentary, and do not constitute investment advice.

There may be additional risks that we have not foreseen or identified in our Terms of Use.

Before buying or selling cryptocurrency, you should educate yourself about digital currencies. Buying and selling entails risks and could result in a complete loss of your funds. You should carefully overthink whether your financial situation and tolerance for risk is suitable for buying, selling or trading cryptocurrency. In case of bankruptcy or liquidation, the Company reserves the right not to return assets served as collateral for crypto loans or used to generate income or served.

19. Market volatility

19.1. Particularly during periods of high volume, illiquidity, fast movement or volatility in the marketplace for any digital assets or legal tender, the actual market rate at which a market order or trade is executed may be different from the prevailing rate indicated via the Services at the time of your order or trade. You understand that we are not liable for any such price fluctuations. In the event of a market disruption or Force Majeure event, we may do one or more of the following: (a) suspend access to the Services; or (b) prevent you from completing any actions via the Services, including closing any open positions. Following any such event, when trading resumes, you acknowledge that prevailing market rates may differ significantly from the rates available prior to such event.

20. Acceptable use

20.1. When accessing or using the Services, you agree that you will not violate any law, contract, intellectual property or other third-party right or commit a tort, and that you are solely responsible for your conduct while using our Services. Without limiting the generality of the foregoing, you agree that you will not: Use our Services in any manner that could interfere with, disrupt, negatively affect or inhibit other users from fully enjoying our Services, or that could damage, disable, overburden or impair the functioning of our Services in any manner; Use our Services to pay for, support or otherwise engage in any illegal gambling activities; fraud; money-laundering; or terrorist activities; or other illegal activities; Use any robot, spider, crawler, scraper or other automated means or interface not provided by us to access our Services or to extract data; Use or attempt to use another user’s account without authorization; Attempt to circumvent any content filtering techniques we employ, or attempt to access any service or area of our Services that you are not authorized to access; Develop any third-party applications that interact with our Services without our prior written consent; Provide false, inaccurate, or misleading information; and Encourage or induce any third party to engage in any of the activities prohibited under this Section.

21. Disclaimer of Warranties

You understand that we cannot and do not guarantee or warrant that files available for downloading from the internet or the Websites will be free of viruses or other destructive code. You are responsible for implementing sufficient procedures and checkpoints to satisfy your particular requirements for anti-virus protection and accuracy of data input and output, and for maintaining a means external to our site for any reconstruction of any lost data.

WE WILL NOT BE LIABLE FOR ANY LOSS OR DAMAGE CAUSED BY A DISTRIBUTED DENIAL-OF-SERVICE ATTACK, VIRUSES OR OTHER TECHNOLOGICALLY HARMFUL MATERIAL THAT MAY INFECT YOUR COMPUTER EQUIPMENT, COMPUTER PROGRAMS, DATA OR OTHER PROPRIETARY MATERIAL DUE TO YOUR USE OF THE WEBSITE OR ANY SERVICES OR ITEMS OBTAINED THROUGH ANY OF THE WEBSITES OR TO YOUR DOWNLOADING OF ANY MATERIAL POSTED ON IT, OR ON ANY WEBSITES LINKED TO IT. YOUR USE OF ANY OF THE WEBSITES, THEIR CONTENT AND ANY SERVICES OR ITEMS OBTAINED THROUGH THE WEBSITES IS AT YOUR OWN RISK. THE WEBSITE, ITS CONTENT AND ANY SERVICES OR ITEMS OBTAINED THROUGH THE WEBSITES ARE PROVIDED ON AN “AS IS” AND “AS AVAILABLE” BASIS, WITHOUT ANY WARRANTIES OF ANY KIND, EITHER EXPRESS OR IMPLIED. NEITHER THE COMPANY NOR ANY PERSON ASSOCIATED WITH THE COMPANY MAKES ANY WARRANTY OR REPRESENTATION WITH RESPECT TO THE COMPLETENESS, SECURITY, RELIABILITY, QUALITY, ACCURACY OR AVAILABILITY OF THE WEBSITES. WITHOUT LIMITING THE FOREGOING, NEITHER THE COMPANY NOR ANYONE RELATED TO OR ASSOCIATED WITH THE COMPANY REPRESENTS OR WARRANTS THAT ANY ONE OF OUR WEBSITES, ITS CONTENT OR ANY SERVICES OR ITEMS OBTAINED THROUGH THE WEBSITE WILL BE ACCURATE, RELIABLE, ERROR-FREE OR UNINTERRUPTED, THAT DEFECTS WILL BE CORRECTED, THAT OUR SITE OR THE SERVER THAT MAKES IT AVAILABLE ARE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS OR THAT SUCH WEBSITE OR ANY SERVICES OR ITEMS OBTAINED THROUGH SUCH WEBSITE WILL OTHERWISE MEET YOUR NEEDS OR EXPECTATIONS.

THE COMPANY HEREBY DISCLAIMS ALL WARRANTIES OF ANY KIND, WHETHER EXPRESS OR IMPLIED, STATUTORY OR OTHERWISE, INCLUDING BUT NOT LIMITED TO ANY WARRANTIES OF MERCHANTABILITY, NON-INFRINGEMENT AND FITNESS FOR PARTICULAR PURPOSE.

SOME JURISDICTIONS DO NOT ALLOW EXCLUSION OF WARRANTIES OR LIMITATIONS ON THE DURATION OF IMPLIED WARRANTIES, SO THE ABOVE DISCLAIMERS MAY NOT APPLY TO YOU IN THEIR ENTIRETY, BUT WILL APPLY TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW.

22. Limitation on Liability

IN NO EVENT WILL THE COMPANY, ITS AFFILIATES OR THEIR LICENSORS, SERVICE PROVIDERS, EMPLOYEES, AGENTS, OFFICERS OR DIRECTORS BE LIABLE FOR DAMAGES OF ANY KIND, UNDER ANY LEGAL THEORY, ARISING OUT OF OR IN CONNECTION WITH YOUR USE, OR INABILITY TO USE, ANY OF OUR WEBSITES, OR ANY WEBSITES LINKED TO THEM, ANY CONTENT ON THE WEBSITES OR SUCH OTHER WEBSITES OR ANY SERVICES OR ITEMS OBTAINED THROUGH OUR WEBSITE OR SUCH OTHER WEBSITES, INCLUDING ANY DIRECT, INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL OR PUNITIVE DAMAGES, INCLUDING BUT NOT LIMITED TO, PERSONAL INJURY, PAIN AND SUFFERING, EMOTIONAL DISTRESS, LOSS OF REVENUE, LOSS OF PROFITS, LOSS OF BUSINESS OR ANTICIPATED SAVINGS, LOSS OF USE, LOSS OF GOODWILL, LOSS OF DATA, AND WHETHER CAUSED BY TORT (INCLUDING NEGLIGENCE), BREACH OF CONTRACT OR OTHERWISE, EVEN IF FORESEEABLE. THE FOREGOING DOES NOT AFFECT ANY LIABILITY WHICH CANNOT BE EXCLUDED OR LIMITED UNDER APPLICABLE LAW (WHICH MAY INCLUDE FRAUD).

THE COMPANY WILL NOT BE LIABLE FOR ANY LOSS OR DAMAGE ARISING FROM ANY USE OF YOUR ACCOUNT BY YOU OR BY ANY THIRD PARTY (WHETHER OR NOT AUTHORIZED BY YOU) INCLUDING BUT NOT LIMITED TO CYBER ATTACKS, UNAUTHORIZED ACCESS BY ANY THIRD PARTY.

23. Indemnification

You agree to defend, indemnify and hold harmless the Company, its affiliates, licensors and service providers, and its and their respective officers, directors, employees, contractors, agents, licensors, suppliers, successors and assigns from and against any claims, liabilities, damages, judgments, awards, losses, costs, expenses or fees (including reasonable attorneys’ fees) arising out of or relating to your violation of these Terms of Use or your use of any Websites or any Services, including, but not limited to, any use of any Website’s content, services and Services other than as expressly authorized in these Terms of Use or your use of any information obtained from any of the Websites.

24. Feedback and Comments

24.1. If you have any feedback, comments, requests for technical support, or other communications relating to the Website, you may contact support by e-mail: [email protected].

25. Governing Law and Jurisdiction

25.1. All matters relating to the Websites or any particular Services and these Terms of Use and any dispute or claim arising therefrom or related thereto (in each case, including non-contractual disputes or claims), shall be governed by and construed in accordance with the internal laws of Republic of Lithuania without giving effect to any choice or conflict of law provision or rule (whether of Republic of Lithuania or any other jurisdiction).

25.2. Any legal suit, action, or proceeding arising out of, or related to, these Terms of Use or the Website or any Services shall be instituted exclusively in the courts of the Republic of Lithuania although we retain the right to bring any suit, action or proceeding against you for breach of these Terms of Use in your country of residence or any other relevant country.

26. Waiver and Severability

26.1. No waiver of the Company of any term or condition set forth in these Terms of Use shall be deemed a further or continuing waiver of such term or condition or a waiver of any other term or condition, and any failure of the Company to assert a right or provision under these Terms of Use shall not constitute a waiver of such right or provision.

26.2. If any provision of these Terms of Use is held by a court or other tribunal of competent jurisdiction to be invalid, illegal or unenforceable for any reason, such provision shall be eliminated or limited to the minimum extent such that the remaining provisions of the Terms of Use will continue in full force and effect.

27. Entire Agreement

27.1. The Terms of Use, and any other terms and policies constitute the sole and entire agreement between you and us with respect to the Websites and supersede all prior and contemporaneous understandings, agreements, representations and warranties, both written and oral, with respect to the Websites.

28. Complaints

28.1. If you have a complaint, you can submit a complaint using our online form or contact the team at: [email protected]. Once we have received your complaint we will acknowledge this via email. We will then investigate all the details of your complaints, and issue our response within a couple of business days, but this can take up to 15 business days.